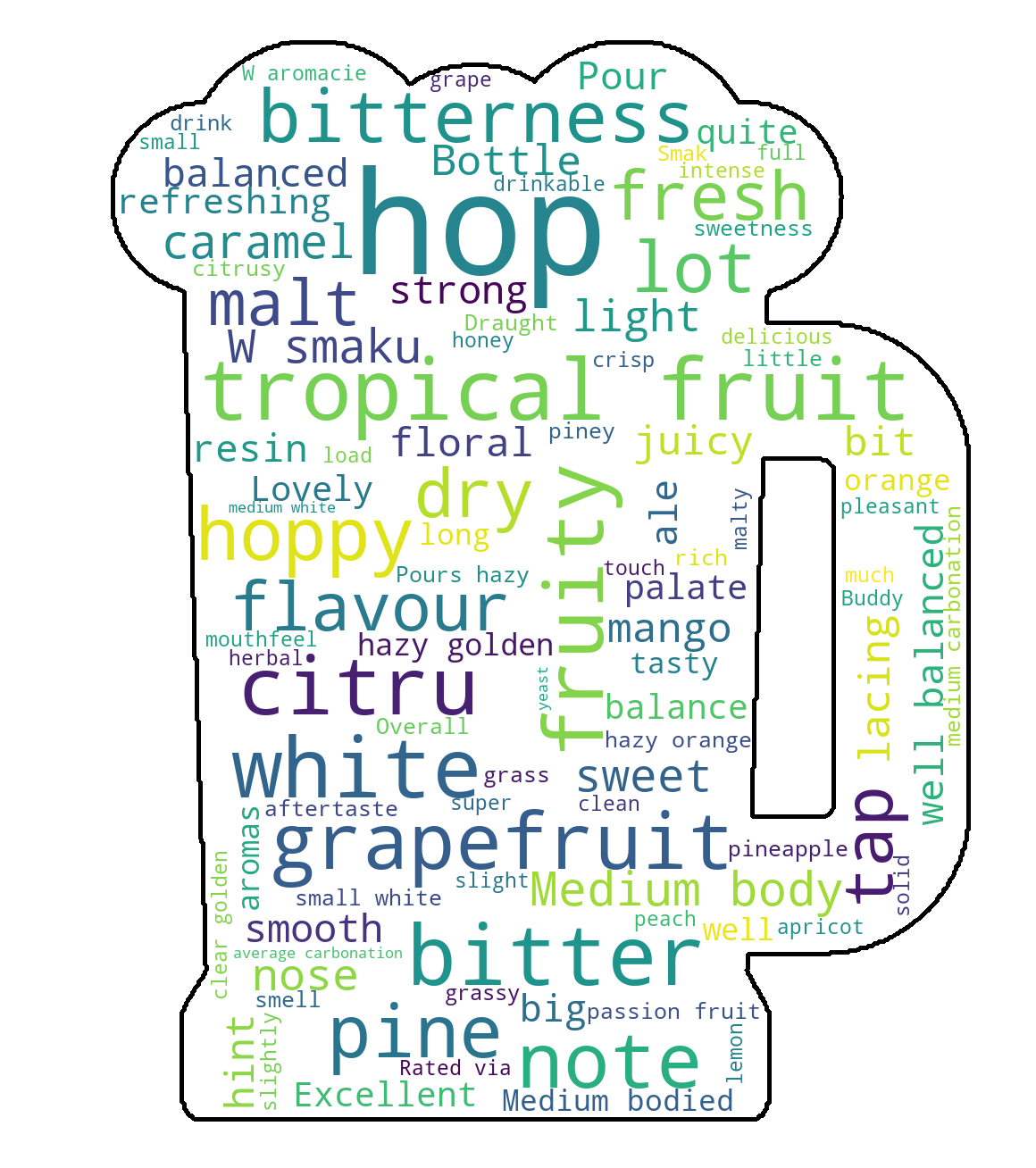

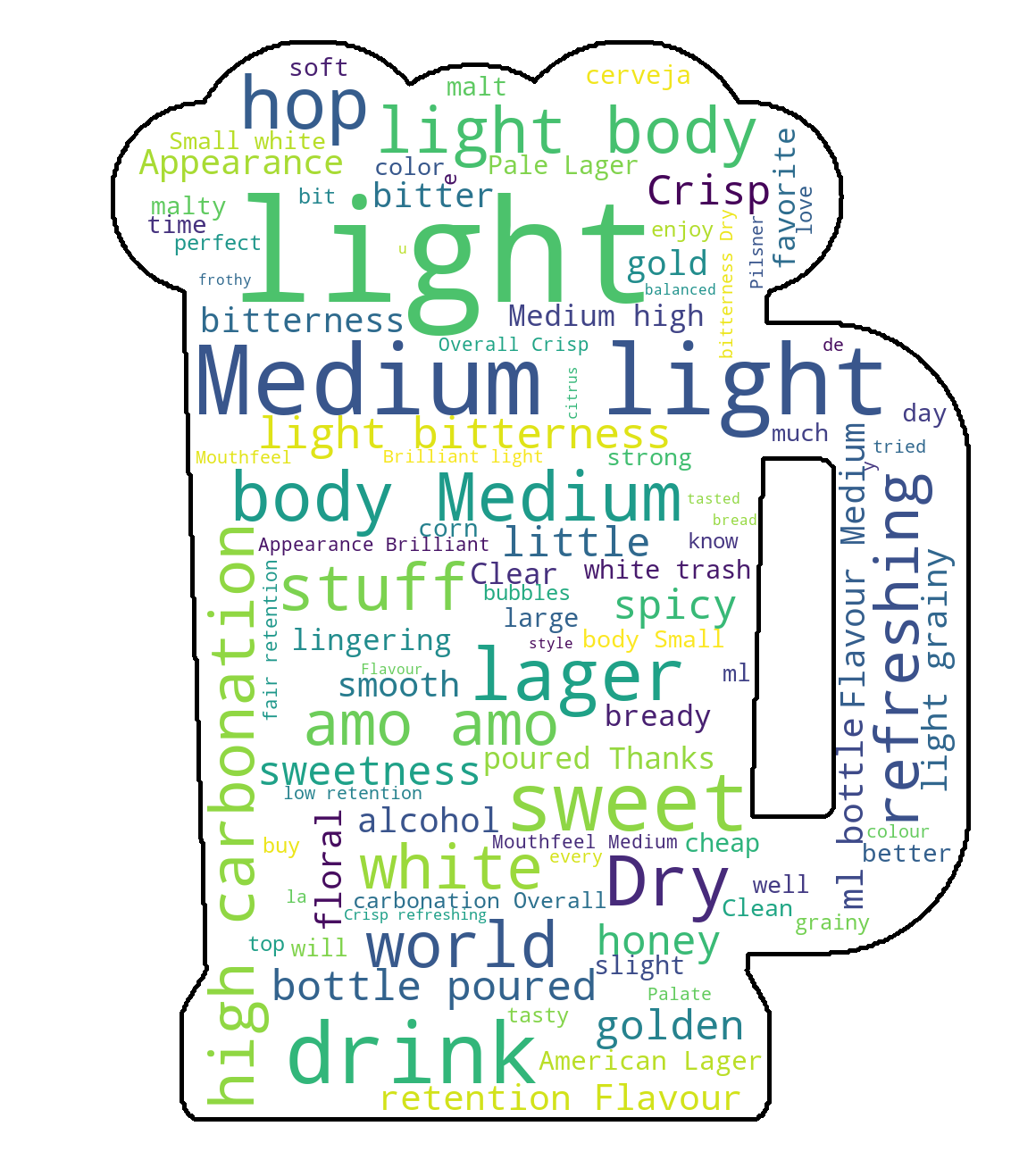

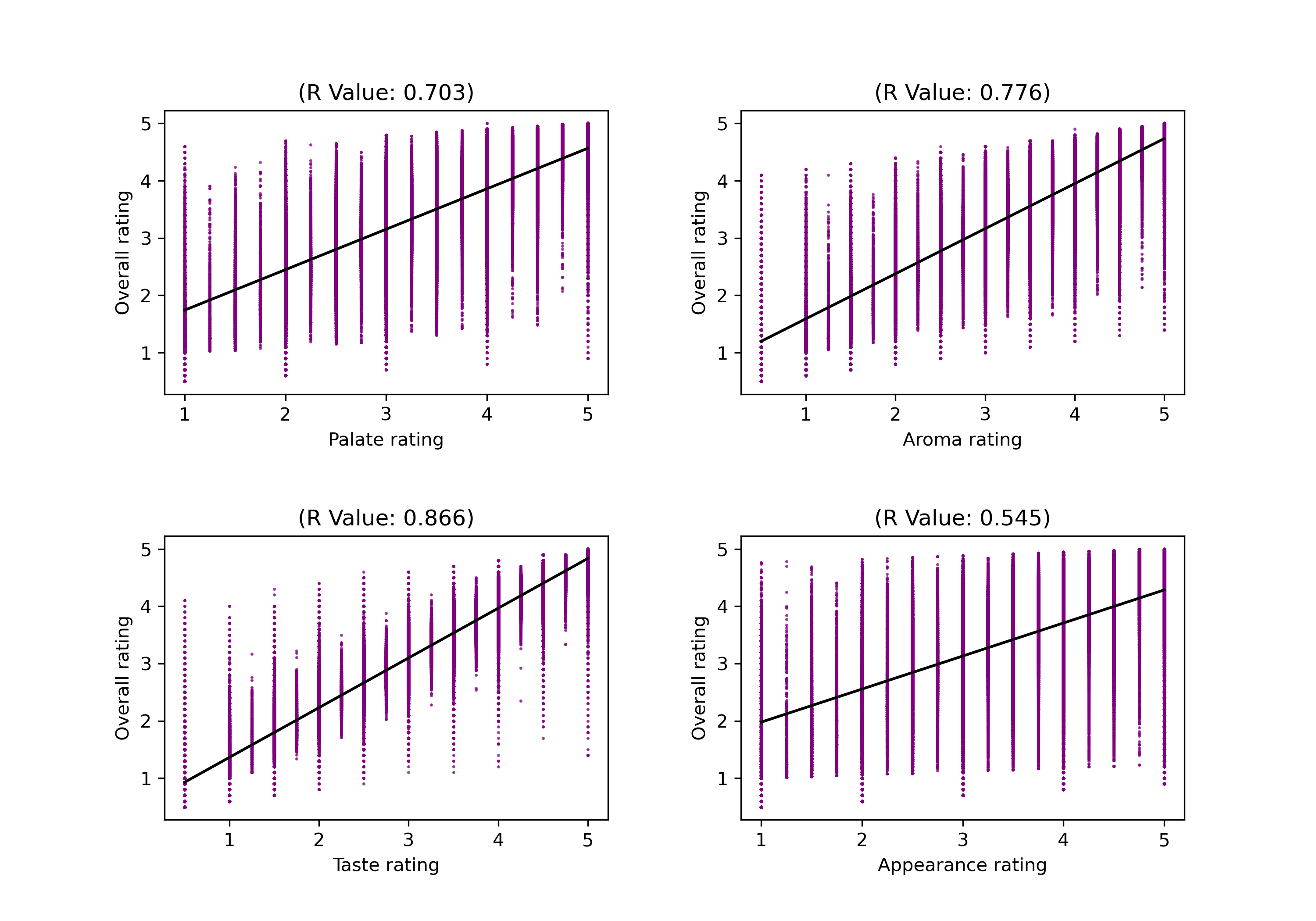

When you’re asked to rate a beer, it might seem like a trivial task: if you like it you give it a good rating and if you don’t you give it a bad rating, simple right? But how you rate a beer can be affected by a plethora of factors that you are not necessarily aware of. Have you ever stopped and wondered what factors can influence your rating of a particular brew? Have you thought about which of your senses are most stimulated when you like a beer? Or that perhaps your culture and environment have shaped your opinion about a beer? In this project, we will delve into the world of beer appreciation and examine both intrinsic and extrinsic factors that can impact how one rates/reviews a beer. We do so by using data from two beer rating websites: RateBeer and BeerAdvocate. We first look into which senses affect most one’s overall perception of a beer. Next, we look into how your location and culture can affect your preference of a beer geographically and in what way. Finally, we look into how your environment, in the form of major events affecting your country, can have an impact on how you review a beer. So grab a pint, sit back, and join us as we delve into the world of beer ratings!